mcm daily market update 01.Apr.22

ST trend: neutral

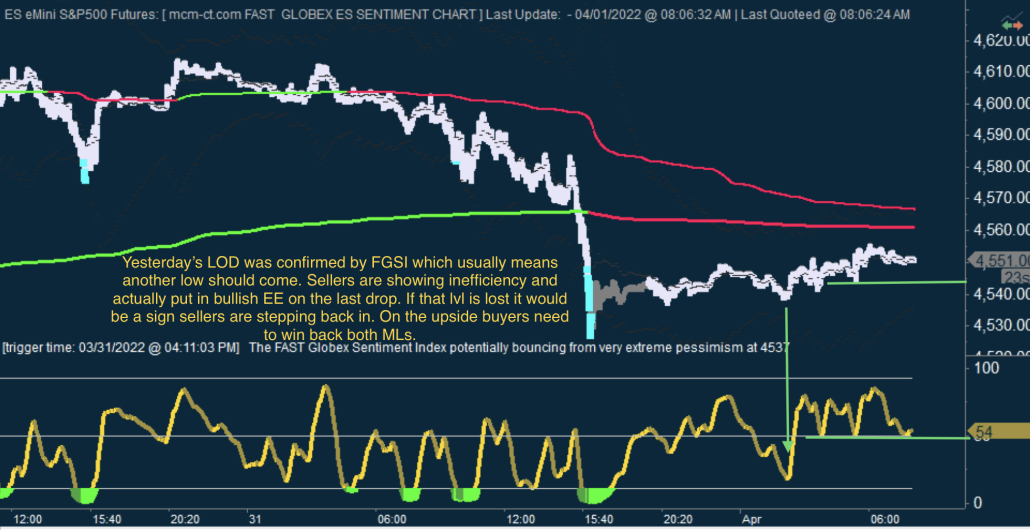

Yesterday we were noting that the ST trend was down as buyers were showing inefficiency via FGSI. Additionally they attempted to win back ML, but failed to hold above it. We did mention that "ML remains the key level for the trend and if it continues to reject price, that would point to another leg lower". That is exactly what played out. ML rejected price and we dropped into a macro-ML test. Macro-ML was also lost towards the end of the RTH session leading to another 40 point flush.

The o/n saw the usual bounce off extreme pessimism on FGSI. However the bounce is a slow grind and is looking more like a bear flag than a change in trend. However not all is bad for buyers. Sellers keep showing inefficiency and actually set up bullish EE on FGSI. Buyers also keep holding 400bar MA as support. If buyers can defend those levels and win back ML, that would be a serious warning they are ready to take the lead again. If those levels break, then another trip to the lows is likely.