mcm daily market update 13.Dec.21

ST trend: neutral

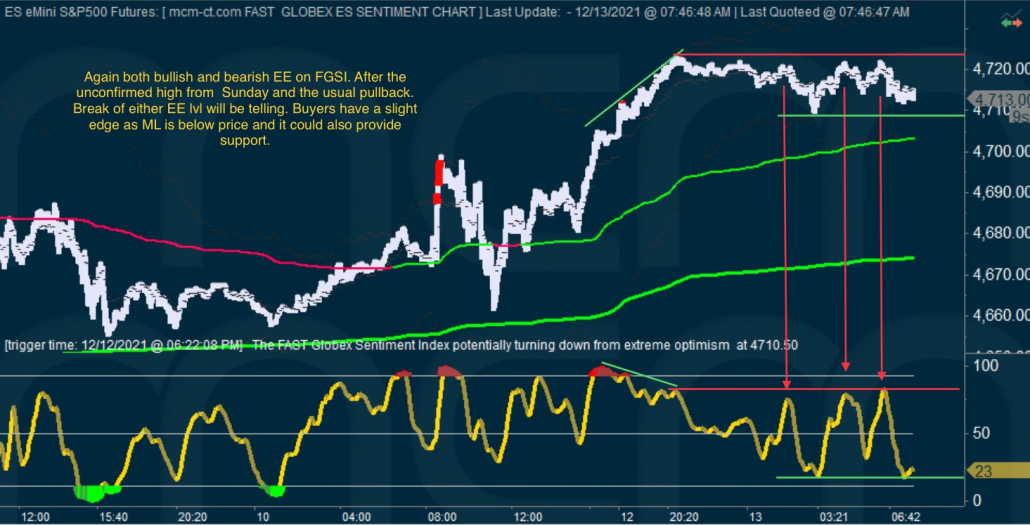

On Friday we were mentioning that the ST trend was up with a potential topping pattern, as buyers had managed to win ML back, but FGSI was at extreme optimism so a pullback was expected. We did note that if buyers could hold ML on that potential pullback, that could set up another push higher, and that is exactly what played out. We got the pullback into a ML test, then buyers launched higher in a vertical ramp off the 8:30am data release. That pushed FGSI back to extreme optimism and the pullback from there tested ML once more, bounced, but the bounce failed and price dropped into a test of macro-ML. Buyers stepped in there, won back ML and held it twice before launching higher. All in all a good day for buyers, which held the up trend intact.

Sunday saw another push higher from Friday's close at the highs and then the usual grind back lower from there. What is worrying for buyers is that they started to show inefficiency via FGSI. So even if the larger trend is up (as ML was won and defended), the ST trend seems to be up for grabs as boths sides are inefficient. We also had an unconfirmed high on FGSI at Sunday's high, so if sellers break the bullish EE lvls and manage to break below ML, then we might see another test of the macro-ML. Buyers on the other hand would need to break Sunday's high to keep running.