mcm daily market update 19.Aug.21

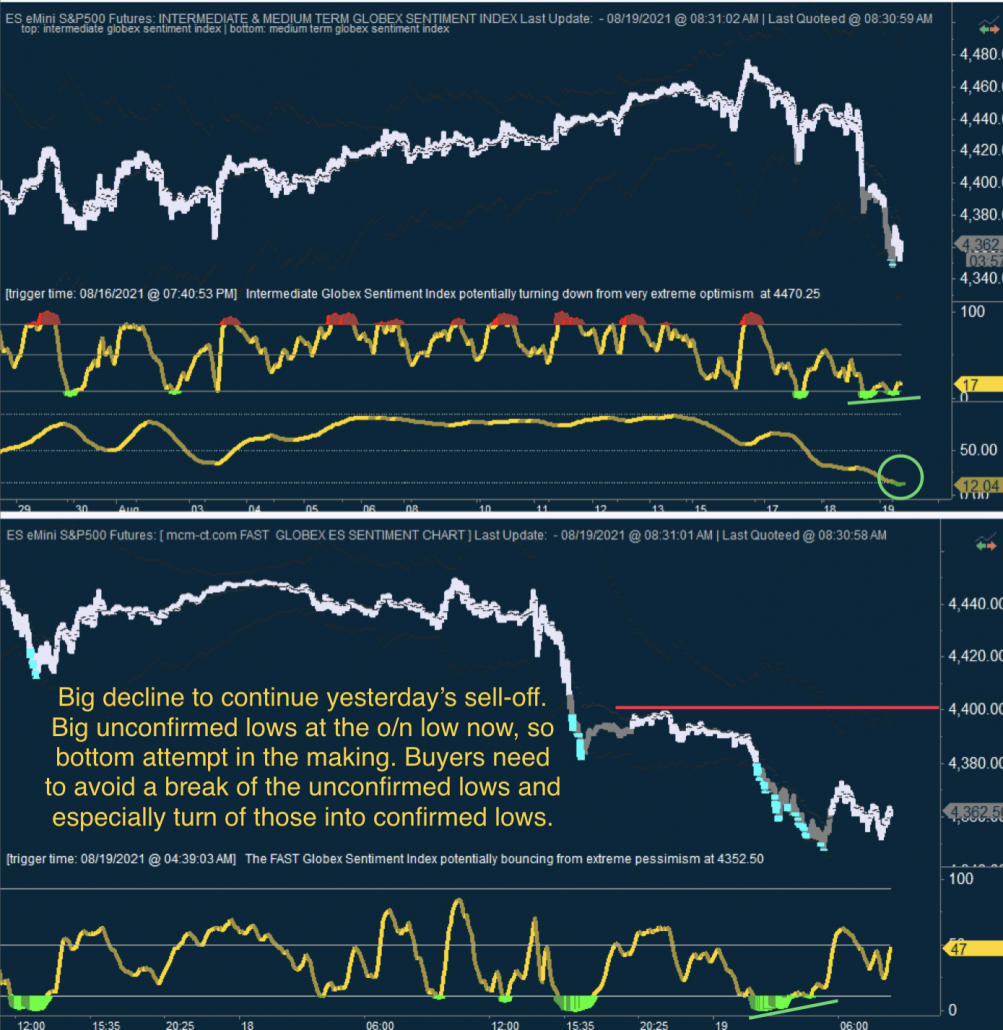

ST trend: down (with potential bottom attempt)

Yesterday we were mentioning that the ST trend was down, as price was still below ML and FGSI was showing both sides were inefficient. The market continues to chop between the bearish and bullish EE on FGSI, and even tried to break above ML after the cash market open, but failed to do so. Once the FED minutes were released it tried again to break above ML, but we got a completing signal on TT, with a Buyer Exhaustion (BE) right at that spike high, which was just above ML. It rejected price strongly and even though buyers stepped in after another TT signal (a SE Xtick), the bounce off there made a lower high and then sellers took complete control.

The o/n saw more downside and even lower lows made, which was to be expected given the big confirmed lows on FGSI and IGSI at the cash close yesterday. However now we do have the potential set-up for a meaningful bottom. Both FGSI and IGSI show unconfirmed lows, while MGSI touched the extreme pessimism area (green zone). That is potentially an explosive set-up for upside. The key to this set-up materializing is ML. If buyers manage to break above ML, then sellers need to be careful as a massive face ripping rally could ensue. If ML rejects price, then we might see more downside. Buyers want to defend those unconfirmed lows and avoid them from turning into confirmed lows. On the other hand, sellers must defend ML at all costs to have a shot at lower lows.