TT – Break-Out/-Down Reversal

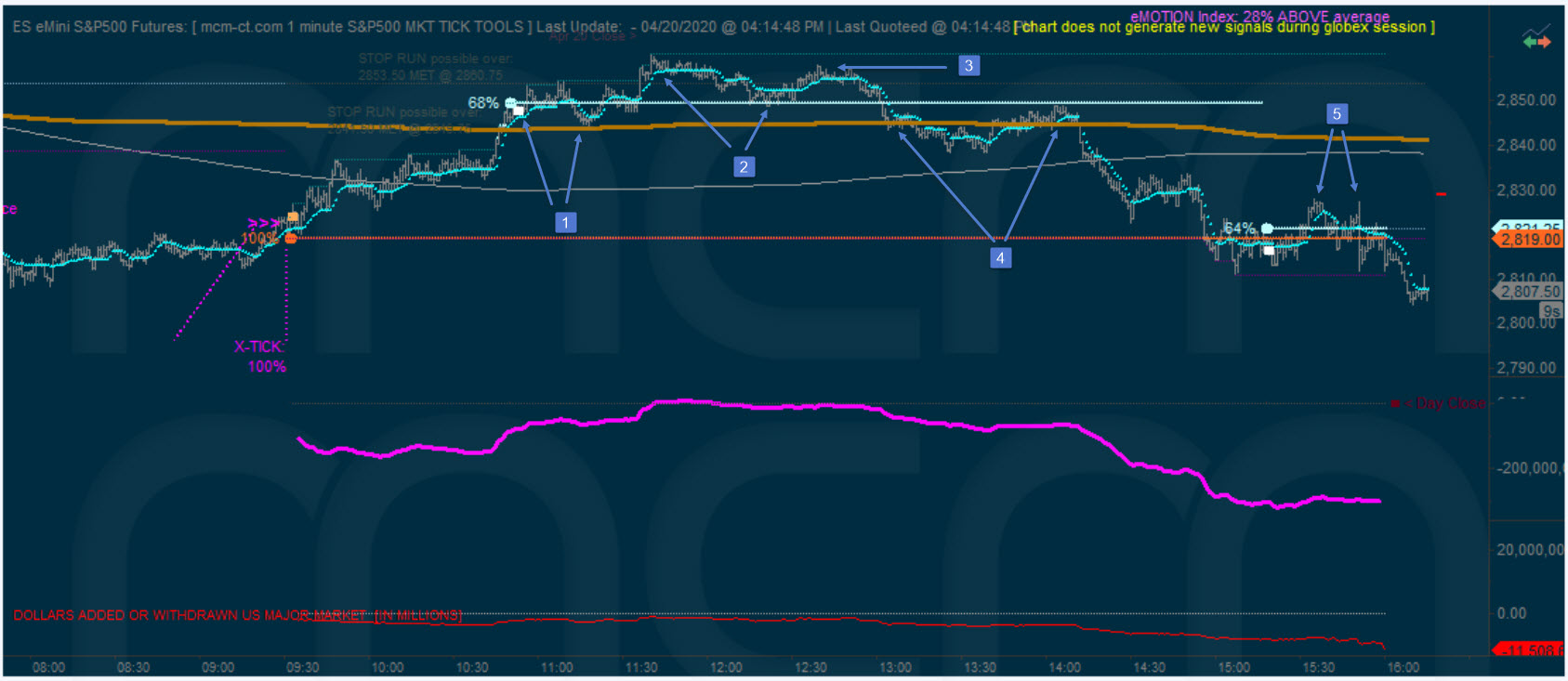

Reversals of attempted breakouts are very negative for the direction in which it is happening. As we can see in the below chart, the session opened with a SE Xtick, which was held cleanly, indicating that buyers were ready to step in.

At point 1 we can see a BE which was triggered, but reaction to it was quite muted and an attempted breakout ensued. The attempt was not very clean, as the initial spike did not go much above the BE level. Buyers did manage to make a higher high after the small back-test (which was more a whipsaw of the BE), but then they failed to push higher and price retreated back below the BE and was held by the maginot line which provided support. They did manage to make another push higher, however at point 2 we can see that although they made a higher high, they failed to breakout and price came back to re-test the BE. That is already a warning sign that the breakout might fail. Normally, after price makes a higher high above the breakout level, the normal expectation is for it to move strongly in that direction. In our case that did not happen and after that high, price retreated a bit and then started to move sideways.

At point 3 we see the final warning and a reason to be defensive with longs - price making a lower high after another back-test of the BE level. If the breakout were to hold, price has to start progressing in that direction.

After the lower high we can see at point 4 that the market came back and fell back below the BE and the maginot line, a double negative. It did try to win back the maginot line and actually tested the BE again, but that was a clean test which pushed the market lower. Given so much momentum on the downside after the failed breakout attempt, it is no surprise that price tried to break below the opening SE.

At point 5 we see another failed breakout attempt, this time more compressed in terms of time, which shows a pretty standard failure. Weak reaction to the BE, which points to a breakout attempt. Spike above the BE which cannot make much progress. Then a sloppy back-test, followed by a lower high vs the spike high.