mcm daily market update 16.Aug.21

ST trend: down

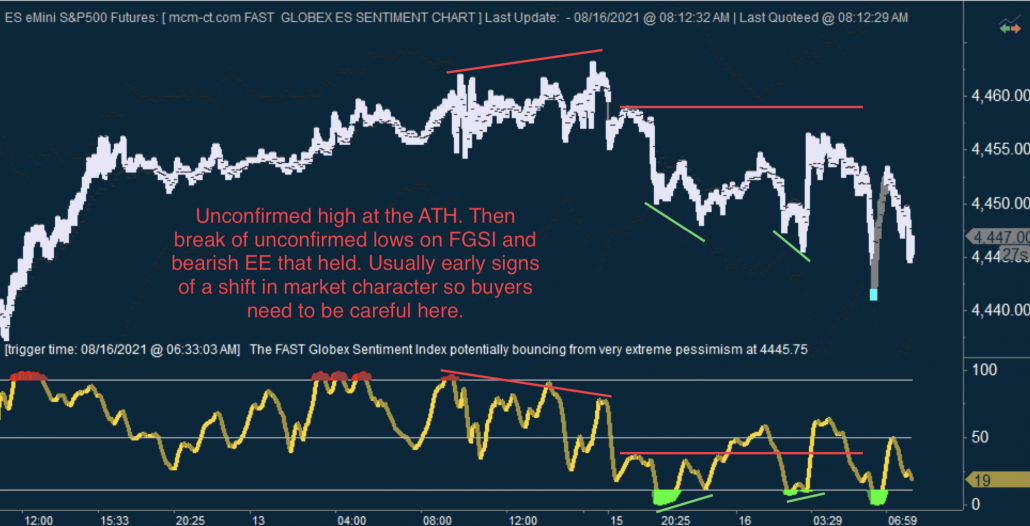

On Friday we were mentioning that the ST trend was up, with potential pullback set-up, as FGSI was at extreme optimism. The pullback was small, then the market pushed to new highs in a very choppy session. It also made a new ATH after hours. The Sunday session saw a pullback from there (the ATH was marked as unconfirmed high on FGSI).

The current o/n saw continuing weakness and what is interesting is that for the first time in a while, the buyers were not able to lift prices back to new highs out of FGSI trips to extreme pessimism. What is more worrying for the buyer side is the fact that 2 unconfirmed lows on FGSI were subsequently broken. That usually marks a shift in market character (i.e.to something more bearish in our case), so it's a big warning that buyers are no longer in full control. ML was also broken by price and now appears to be holding as resistance. That also confirms a more bearish ST picture. Going fwd, it is important to see how price acts in relation to danny and ML. For buyers to get back in control, they must break back above ML. if they can do that, this might be another failed breakdown from seller side. However if ML continues to act as resistance and price continues lower, this might be the 1st trend down day we had in a while. This week is OPEX so shake-outs in both directions are to be expected. Considering that markets are so extended, a bigger pullback would not be out of the question (1st target 4408-4415 - large fractals on 60 and 135min cycles. Below that - 2nd target is 4370-4380 and the bottom of the prior trading range).