mcm daily market update 22.Jul.22

ST trend: neutral (with potential larger topping pattern)

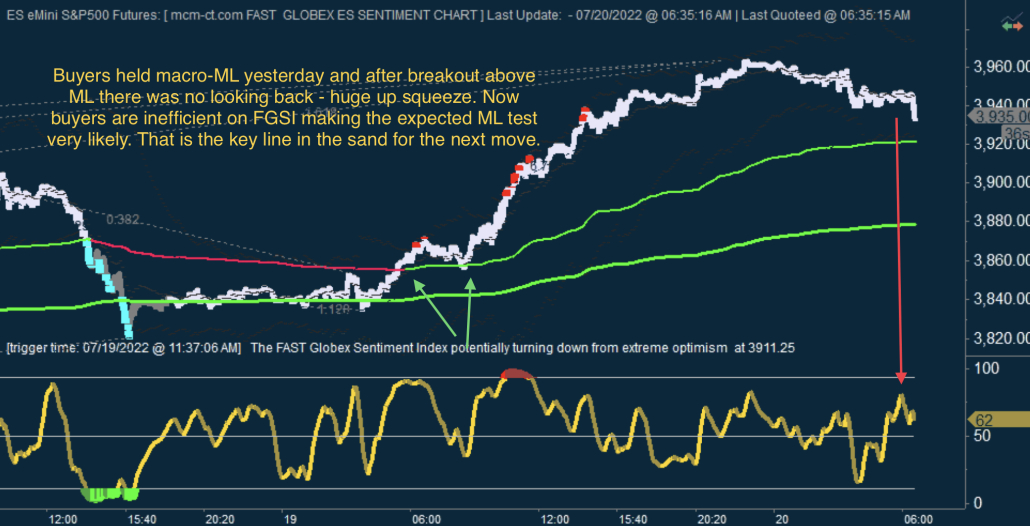

Yesterday we were noting that the ST trend was neutral, as buyers were inefficient via FGSI, having put in bearish EE vs the prior HOD, and price was testing ML once again. We did mention that ML was key for the trend and buyers managed to defend it initially bouncing to near the o/n high, but head-faked the breakout and droped below ML. That was a head-fake too, as it was then very quickly recovered and buyers pushed to new highs closing at the highs too.

The o/n saw us pullback from the new high and the pattern is a bit worrying for bulls. That squeeze high was unconfirmed on all 3 GSIs (FGSI, IGSI and MGSI). Additionally both FGSI and IGSI peaked at extreme optimism close to there. And both FGSI and IGSI have geo/fib ratios converging there. That means that yesterday's HOD is THE key level for bulls. They cannot affort to pause here, because if this pulls back it will look like a ST top from where a multi-day decline can start. ML is key, as always. As long as ML is defended, this can be just another "usual" pullback before running back higher. If yesterday's unconfirmed high is not reversed (i.e.bested and turned into a confirmed high) and ML is lost, then the larger topping pattern will be confirmed and bulls will want to be careful for a while.

EWT wise the wave counts align well with TTs. Yesterday's final push looked like an ending diagonal (ED). Which also makes that high the key overlap, just like shown by TTs. If ED, then the entire move off 3720 might be done and would need to be retraced at one of the usual Fibs (38,2%, 50% or 61,8%) before (potentially) resuming the up trend.