mcm daily market update 5.Mar.21

ST trend: neutral (with bearish risk)

It seems the market stopped tipping its hand in the o/n session and keeps things in suspense until the cash market open. For several days we were noting that the trend was neutral as both sides were showing inefficiency via FGSI in the o/n session. Yesterday the buyers staged an attack over ML to get us back to an uptrend, but failed just above as the markets were disappointed by Powel's remarks. Funny how that works. So just to mention this again: ML is a KEY level for the overall trend. If price is above, we have a bullish bias, while if price is below - bearish.

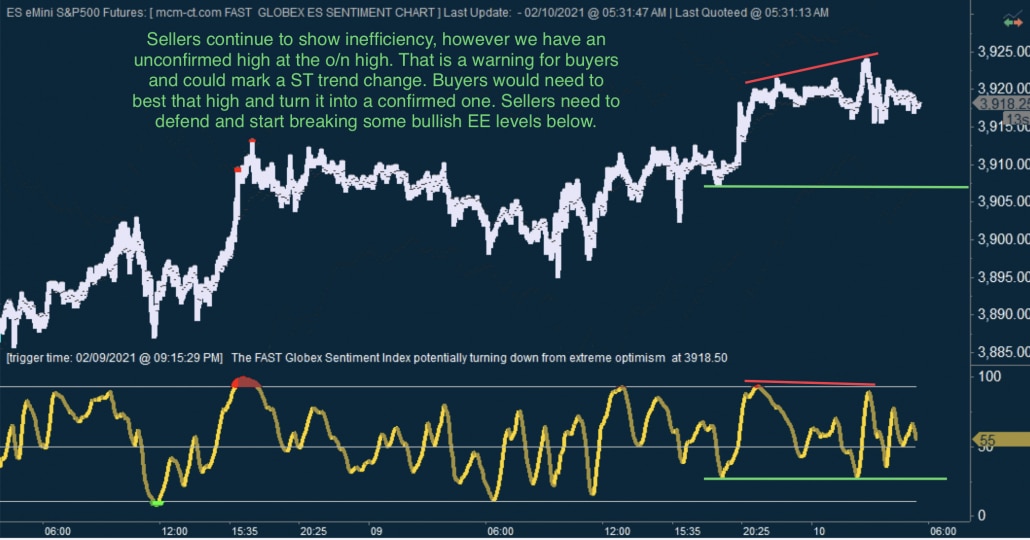

In the o/n, both buyers and sellers were inefficient, as the market still tries to digest the mini-crash off Powel's statements. We have bearish EE above which held price action and pushed it lower and now bullish EE set up with FGSI bouncing from extreme pessimism. Those levels remain important and a breach would mean one side is getting the upper hand. Buyers want to hold the bullish EE and ideally to break back above ML. That would help them and could trigger a "relief rally". Sellers want to make a stand at (or below) ML and try to attack yesterday's LOD. Breaking the bullish EE level would help them significantly.