mcm daily market update 23.Mar.22

ST trend: down (larger correction attempt)

Yesterday we were noting that the ST trend was up as buyers had held another ML test and bounced off it. Indeed from our post, the market consolidated briefly, then ramped another 50+ points to breach 4500. The RTH session was a "ramp 'n camp" as after the initial push, there was a choppy slow grind.

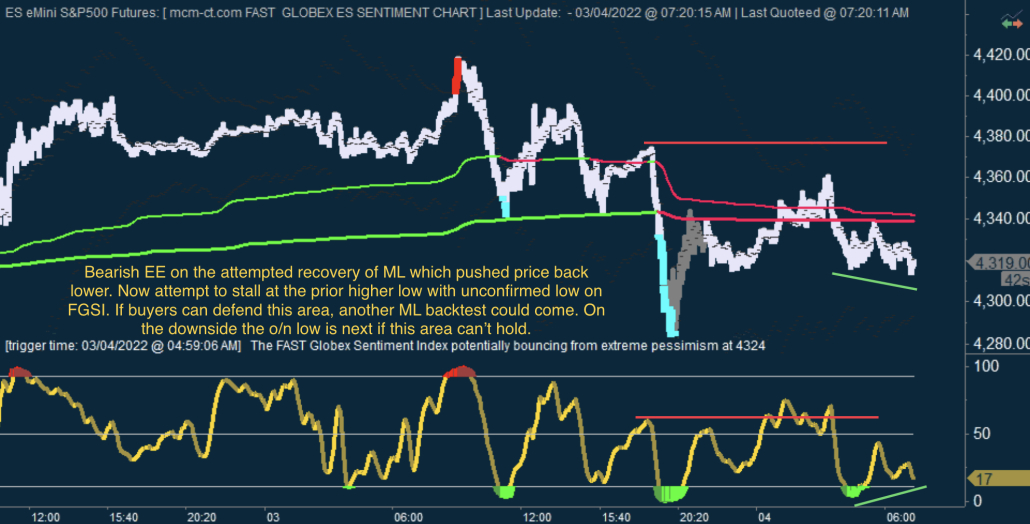

The o/n saw a pullback from those new highs and we again had buyers being inefficient, which was a warning they might not be able to sustain such a relentless push. And now we dropped into yet another ML test. As we kept mentioning, ML is the KEY level for the main trend. If buyers can win back ML, then this is just another small dip to be followed by new highs. If ML is lost on a sustained basis, then a trip to macro-ML (aprox 50 points lower) is possible and likely next large inflection point.